Microfinance เป็นอีกหนึ่งทางออกสำหรับการเข้าถึงแหล่งเงินทุนของผู้มีรายได้น้อย หรือ ไม่มีหลักทรัพย์คำ้ประกันเงินกู้ เพราะการเข้าถึงเครดิตเงินทุน เพื่อการพัฒนารายได้ชุมชน รายได้ครัวเรือน ที่มีความจำเป็นในหลายครอบครัว สภาพคล่อง ที่คอยหมุนเวียนช่วยเหลือให้ชุมชนเกิดความเข้มแข็ง นี่คือ แนวคิด การให้ “เครดิต” ที่ไม่ได้มุ่งหวังกำไรเป็นพื้นฐาน แต่คิดเพื่อการสร้างอนาคตให้กับชุมชน ด้วยสังคม ที่สนับสนุนให้ชาวบ้านพร้อมขับเคลื่อนอาชีพและรายได้ ด้วยเงินทุนที่เป็นธรรม กับ บริษัท พัฒนาธุรกิจขนาดย่อม จำกัด

กับ โมเดล Microfinance ธุรกิจเพื่อสังคมที่ช่วยสนับสนุนกลุ่มสตรีออมทรัพย์ในพื้นที่ชนบทภาคอีสานในเรื่องการให้สินเชื่อเงินกู้เพื่อเป็นเงินทุนให้ทุกคนได้ไปต่อยอดแล้วสามารถยืนได้ด้วยตัวเองอย่างเข้มแข็ง โดย บริษัท พัฒนาธุรกิจขนาดย่อม จำกัด ทำหน้าที่ในการใส่เมล็ดพันธุ์ให้กับชุมชนในรูปแบบของเมล็ดเงินซึ่งเป็นสินเชื่อเงินกู้ เพื่อเป็นเงินทุนให้แก่กลุ่มสตรีในชุมชนภาคอีสานที่ไม่อาจเข้าถึงแหล่งเงินทุนในระบบปกติได้ เมล็ดพันธุ์ที่ถูกปลูกฝังไว้จะทำให้ชุมชนสามารถงอกเงยต่อยอดเป็นต้นไม้ที่แข็งแรงและสามารถเกื้อกูลกันได้อย่างเป็นระบบ

ในตอนนี้แอดมินจะพาทุกคนไปรู้จักกับอีกหนึ่งธุรกิจวิสาหกิจเพื่อสังคม ซึ่งหากเราได้ยินแนวคิดเราอาจจะคิดว่าธุรกิจนี้ไม่ได้แตกต่างจากสถาบันทางการเงินหลักในประเทศของเรามากนัก แต่ความจริงที่เราปฏิเสธไม่ได้เลย ก็คือมีคนในชุมชนชนบทมากมายที่ห่างไกลเกินกว่าจะเข้าถึงสถาบันการเงินหลักและยังขาดความรู้อยู่มากเกี่ยวกับการบริหารจัดการเงิน จึงทำให้เกิดเงินกู้นอกระบบ อัตราดอกเบี้ยที่สูงเกินกว่ากฎหมายกำหนด และการทวงหนี้โดยใช้ความรุนแรง นี่จึงเป็นหนึ่งในสาเหตุที่ทำให้ บริษัท พัฒนาธุรกิจขนาดย่อม จำกัด ลุกขึ้นมาแก้ไขปัญหาในเรื่องนี้ ซึ่งเราจะไปศึกษาวิธีการอุดรอยรั่วในสังคมนี้จากบทสัมภาษณ์ของ คุณอิทธิฤทธิ์ สุวรรณคำ ผู้ช่วยผู้จัดการฝ่ายวิชาการและแหล่งเงินทุนสัมพันธ์บริษัท พัฒนาธุรกิจขนาดย่อม จำกัด

จุดเริ่มต้นของ บริษัท พัฒนาธุรกิจขนาดย่อม

บริษัทฯ เริ่มต้นจากการเป็นเพียงแค่โครงการพัฒนามาก่อนในช่วงปี 2531 – 2539 ชื่อโครงการส่งเสริมกิจกรรมกองทุนหมุนเวียนหมู่บ้าน ได้รับงบในการพัฒนาจากองค์กรต่างประเทศ มีการส่งเสริมสตรีในพื้นที่สุรินทร์และบุรีรัมย์ในการจัดตั้งกลุ่มสตรีออมทรัพย์ ช่วงแรกเป็นการทำงานปล่อยสินเชื่อผ่านกลุ่มพันธมิตร หลังจากนั้นจึงปรับกระบวนการทำงานและได้เริ่มจดทะเบียนเป็นบริษัทจำกัดในปี 2539 ในช่วงนั้นองค์กรต่างประเทศได้ถอนตัวออกจากประเทศไทย เพราะเขามองว่าโครงการดำเนินการมาระยะหนึ่งแล้ว อยากให้องค์กรมั่นคง และอยู่ได้ด้วยตัวเองในระยะยาว

“ทำไมต้องเป็นสตรีออมทรัพย์?”

จุดเริ่มต้นของแนวคิดนี้มาจากการเป็นธนาคารที่ส่งเสริมการออมทรัพย์ของสตรี มีองค์กรต่างประเทศที่มองเห็นความสำเร็จเกี่ยวกับบทบาทของผู้หญิงในการจัดการเรื่องเงิน แนวคิดนี้ก็ถูกกระจายออกไปในวงกว้าง ซึ่งประเทศไทยเป็นอีกพื้นที่หนึ่งที่ได้รับอิทธิพลในเรื่องนี้ เพราะทางบริษัทก็มองว่าผู้หญิงมีบทบาทและมีศักยภาพในการจัดการเรื่องเงินที่พิเศษจริงๆ เมื่อมีแนวคิดตรงนี้จึงคิดว่าเป็นโอกาสที่ดี ที่จะให้ผู้หญิงเข้ามาจัดการในเรื่องนี้

“3 เดือนกับการพัฒนาศักยภาพก่อนรับสินเชื่อ”

คุณอิทธิฤทธิ์ เล่าว่าก่อนที่จะเปิดกลุ่มริเริ่มโครงการนี้มีกระบวนการเตรียมตัวที่ใช้เวลาไปไม่ต่ำกว่า 3 เดือน เริ่มตั้งแต่การชี้แจง การทำความเข้าใจพื้นที่ การทดลองอดออมของกลุ่มที่เลือกเป็นเวลา 3 เดือน มีการจัดอบรมเรื่องบัญชีและการเงิน มีการลงไปให้คำแนะนำตามพื้นที่ด้วย ซึ่งคนที่ลงไปทำหน้าที่ตรงนี้เราจะเรียกว่า คณะกรรมการกลุ่มสตรีออมทรัพย์ โดยกลุ่มที่ทางบริษัทจะปล่อยสินเชื่อให้ต้องเป็นกลุ่มที่ได้รับการประเมินจากกรรมการแล้วว่ามีศักยภาพครบถ้วน

บทบาทของ บริษัท พัฒนาธุรกิจขนาดย่อม

บริษัทฯ จะลงพื้นที่ ให้ความรู้ พัฒนาคนในชุมชนให้รู้จักการออม เพื่อทำให้แน่ใจว่าแต่ละครอบครัวสามารถออมเงินได้จริง ซึ่งเงินออมตรงนี้จะเป็นเงินตั้งต้นที่นำไปปล่อยสินเชื่อเงินกู้ แต่ละกลุ่มจะมีศักยภาพการออมที่แตกต่างกันเช่น บางคนจ่ายเดือนละ 50 บาท หรือบางคนจ่ายเดือนละ 100 บาท เป็นต้น เงินออมที่กลุ่มชาวบ้านเก็บกันมา กว่าที่จะสามารถปล่อยให้สมาชิกกู้ได้นั้นต้องใช้เวลานาน บริษัทจึงมีหน้าที่ในการเสริมเงินตรงนี้เข้าไปเพื่อให้พวกเขาได้ไปปล่อยกู้ พวกเขาสามารถเก็บสะสมดอกเบี้ยเอาไว้ได้เพื่อให้กลุ่มเติบโตขึ้นในระดับที่สามารถดำเนินกิจการต่อไปได้แม้บริษัทจะถอนตัวออกมา และในส่วนของบริษัทจะเก็บดอกเบี้ยในส่วนของบริษัทเองคณะกรรมการที่เข้ามาทำงานก็จะมีรายได้จากตรงนี้

ความแตกต่างจากการปล่อยเงินกู้ของสถาบันทางการเงินอย่างไร?

ส่วนใหญ่กลุ่มเป้าหมายที่บริษัทฯ ทำงานด้วยคือคนที่ต้องการสินเชื่อไปหมุนเวียนในกิจการแต่ขาดหลักทรัพย์ในการค้ำประกันหนี้ จึงไม่สามารถเข้าถึงแหล่งเงินกู้กระแสหลักได้ บางกรณีเข้าสู่วงจรหนี้นอกระบบ ดอกเบี้ยสูง แน่นอนว่าไม่มีหลักทรัพย์ในการนำไปค้ำประกันเงินกู้สถาบันหลักอยู่แล้ว ทางบริษัทจึงเป็นตัวช่วยในการปล่อยสินเชื่อเงินกู้โดยไม่ต้องใช้หลักทรัพย์ใดมาค้ำประกัน

“คนชนบทขาดโอกาสในการเข้าถึงแหล่งเงินทุน”

คุณอิทธิฤทธิ์ เล่าว่าบริษัทฯ มีวัตถุประสงค์หลักในการแก้ปัญหาเรื่องแหล่งเงินทุน แม้ในตอนแรกตั้งใจจะเป็นเพียงการสร้างทางเลือกในการเข้าถึงแหล่งเงินทุนสำหรับสตรีในพื้นที่ชนบท แต่ปัจจุบันมีการขยายขอบเขตไปสู่ผู้ชายด้วยแล้ว โดยเริ่มต้นจากจังหวัดสุรินทร์เป็นที่แรก ต่อมาจึงมีการขยายไปยังบุรีรัมย์ ศรีสะเกษ และในอนาคต มีแผนขยายไปยังอุบลราชธานีอีกด้วย บริษัทเริ่มต้นการแก้ปัญหาจากภาคอีสานก่อนเพราะถ้าดูในเรื่องของรายได้ต่อหัวต่อปีแล้ว ภาคอีสานมีกลุ่มประชากรรายได้ต่ำเยอะกว่าภาคอื่นในประเทศไทย

“การเป็นสินเชื่อที่ไม่มีหลักทรัพย์ค้ำประกันเป็นธุรกิจที่มีความเสี่ยงสูง”

อุปสรรคของบริษัทฯ ไม่ต่างจากสถาบันทางการเงินทั่วไปเลย การเป็นสินเชื่อที่ไม่มีหลักทรัพย์ค้ำประกัน มีความเสี่ยงสูงมาก มีหนี้ค้างชำระจำนวนมากซึ่งทางบริษัทดำเนินการแก้ไขอยู่อย่างต่อเนื่อง เวลาที่ทางบริษัทปล่อยสินเชื่อ เจ้าหน้าที่กับกรรมการแต่ละกลุ่มจะเจอกันทุกเดือน เมื่อเกิดปัญหาอะไรขึ้นมา ทั้ง 2 ฝั่งจะมีการปรึกษากัน เหมือนองค์กรการเงินทั่วไปเลย จะแตกต่างกันก็ที่วิธีการแก้ปัญหา

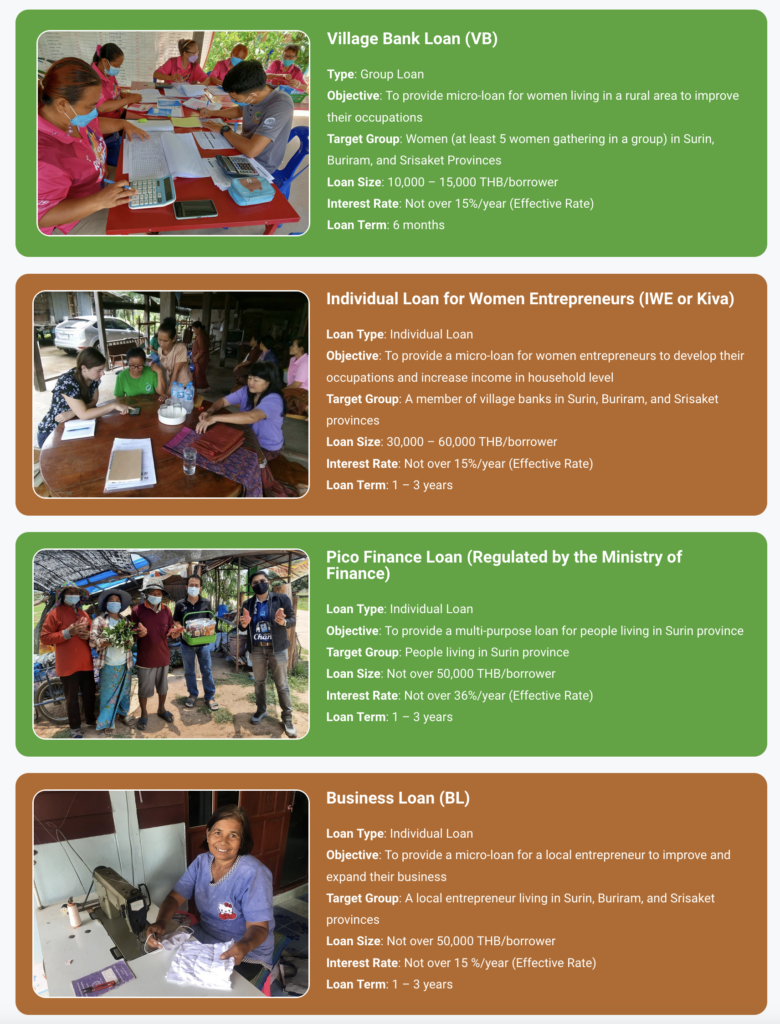

บริษัทมีการบริการด้านใดบ้าง?

คุณอิทธิฤทธิ์อธิบายว่าตอนนี้ทางบริษัทฯ มีสินเชื่อที่ปล่อยผ่านกลุ่มสตรีออมทรัพย์ ซึ่งขนาดสินเชื่อมีจำกัด เช่น มีการกู้ยืมในกลุ่มได้ไม่เกิน 15,000 บาทต่อคน หากใครต้องการจำนวนเงินมากกว่านั้น สามารถใช้บริการอื่นอย่างสินเชื่อเพื่อพัฒนาธุรกิจหรือสินเชื่อสำหรับสตรีผู้ประกอบการเพื่อเพิ่มวงเงินสินเชื่อได้ นอกจากนี้ยังมีการให้บริการที่นอกเหนือจากเรื่องเงินทองอย่าง การจัดหาเส้นไหมสำหรับกลุ่มทอผ้าไหม ซึ่งเป็นการจัดหาวัตถุดิบเพื่อส่งเสริมอาชีพให้แก่คนในกลุ่ม

“ความต้องการเสริมสร้างชุมชนให้แข็งแรง”

ที่ผ่านมาทางบริษัทฯ มีความพยายามที่ขยายขอบเขตการบริการให้ครอบคลุมไปยังส่วนอื่นมาตลอด แต่ด้วยศักยภาพของบริษัทในตอนนี้ทำให้บริษัทมีการปล่อยสินเชื่อให้แค่กลุ่มสตรีออมทรัพย์เท่านั้น เนื่องจากทางบริษัทเป็นสินเชื่อที่ไม่มีหลักทรัพย์ค้ำประกัน จึงมีความเสี่ยงสูง แต่คนในกลุ่มสตรีออมทรัพย์มีการประเมินจากคณะกรรมการระยะหนึ่งแล้ว จึงถือว่ามีการการันตีให้กับบริษัท ทางบริษัทต้องการเสริมสร้างชุมชนให้แข็งแรงโดยเริ่มจากคนในกลุ่มชุมชนนี้ก่อน

ความสำเร็จของบริษัทฯ ที่ผ่านมา บริษัทได้มีการนำเทคโนโลยีเข้ามาอุดช่องโหว่และแก้ปัญหาในเรื่องการปล่อยสินเชื่อให้สะดวกและลดค่าใช้จ่ายลงไปอีก เพราะจำนวนกลุ่มเป้าหมายมีการเติบโตอย่างเห็นได้ชัด ส่งผลให้บริษัทก็เติบโตขึ้นด้วยเมื่อเทียบกับปีที่ผ่านๆมา แหล่งเงินทุนของบริษัทเพิ่มขึ้น ในปัจจุบันมีการระดมสินเชื่อผ่านแพลตฟอร์มออนไลน์ ขยายแหล่งเงินทุนออกไปเรื่อยๆ เมื่อแหล่งเงินทุนเยอะขึ้น ก็สามารถเป็นต้นทุนในแก่คนในชุมชนได้มากขึ้น

บทสรุป

การทำธุรกิจวิสาหกิจเพื่อสังคม จุดเริ่มต้นขึ้นอยู่กับปัญหาในแต่ละพื้นที่และศักยภาพของแต่ละคนหรือแต่ละองค์กร อย่างเช่นในส่วนของบริษัท พัฒนาธุรกิจขนาดย่อม จำกัด ซึ่งจริงๆ แล้ว ได้มองเห็นปัญหาหลายเรื่องในจังหวัดสุรินทร์ แต่เรื่องของการเงินเป็นเรื่องที่ทางบริษัทเชี่ยวชาญอยู่แล้ว จึงเชื่อว่าถ้ามีความเชี่ยวชาญก็จะทำมันได้ดี ในส่วนของประเด็นปัญหาสังคมอื่นก็ปล่อยให้องค์กรอื่นที่เชี่ยวชาญทำไป ถ้าในอนาคตข้างหน้ามีโอกาสในการร่วมมือกันแก้ปัญหาสังคมก็ค่อยร่วมมือกันหรือบูรณาการร่วมกันได้

“ดูศักยภาพขององค์กรและปัญหาในพื้นที่เป็นหลัก ลองมองหาทั้ง 2 สิ่งที่สอดคล้องกันให้เจอ เราเก่งเรื่องไหนให้ช่วยเรื่องนั้น”

เงินทุน”เพื่อน”สังคม | The Practical Sustainability วิสาหกิจ “เพื่อน” สังคม

หรือ จะเลือกรับฟังรายการ ในรูปแบบของ Podcast ได้ที่:

ช่องทางการติดต่อ

บริษัท พัฒนาธุรกิจขนาดย่อม จำกัด ที่อยู่ 271, Moo 7, Salakdai Sub-district, Mueang District, Surin Province, Thailand, 32000 โทร (66) 44-065-744 เว็บไซต์ https://www.sedcompany.org/ และ อีเมล์: sed.surin@yahoo.com

สนับสนุนโดย สำนักงานส่งเสริมวิสาหกิจเพื่อสังคม (สวส.)

บทความแนะนำ :

พื้นที่ปลอดภัย ท่ามกลางความหลากหลาย กับ Pulse Clinic

โครงการเหลือขอ เพื่อเปลี่ยนสิ่งของที่เหลือใช้ให้เป็น “โอกาส”